OK I’m back in the flat and looking at printouts of last year’s French tax return.

I declared the UK rental income under the “régime du réel” and that required me to first declare them in form No 2044.

We have 2 rentals and they had to be declared in form 2044 separately.

For each property I completed boxes

211 (loyers bruts encaissés),

215 (Total des recettes) ,

221 (frais d’administration et de gestion),

222 (autres frais de gestion),

223 (primes d’assurance),

224 (dépenses de réparation, d’entretien et d’amélioration),

227 (taxes foncières),

240 (total des frais et charges),

261 (Ligne 215 - ligne 240 - ligne 250) and

263 (bénéfice ou déficit).

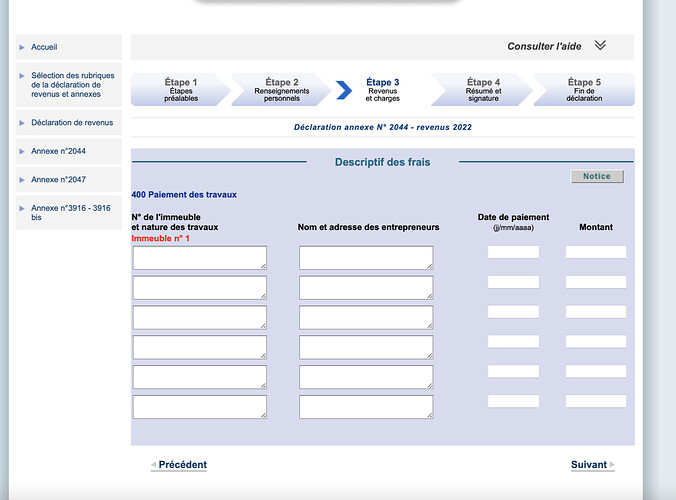

In connection with Ligne 224, I had to itemise the expenditure (nature des travaux, nom et adresse des entrepreneurs, date du paiement, montant).

Perhaps I didn’t need to do this. Presumably I responded to some prompt but can’t remember what shape and form it took!

So I did all this for both properties and the form generated a total “recettes” figure (E), a total “frais” figure (F) and, finally, a total profit figure (bénéfice ou déficit) (I)

That was form 2044 done & dusted.

Then in Form 2047, I completed section 6, entering the total profit figure (I) under “revenu avant déduction de l’impôt étranger”

I don’t think the figure was carried over automatically from form 2044 - am pretty sure I entered it.

Then, in the main tax form 2042, that same total profit figure appears under:

4BA

4BL

and 8TK

I think I need a drink.

P.S. Every year I also include a very polite reminder under Mention Expresse to the effect that under the bilateral tax treaty, UK rental income is not liable to tax or social charges in France