There must be some reason I’m paying tax on my premium bond winnings…one day that number could appear! ![]()

![]()

If only ![]()

If drawdown is treated as income , is there a social charge element ?

I think that might depend on your S1 status (if you have one).

Yes there was for me (but I was not S1).

Like others who have realised how much of a con the annuity system is, I am looking at the implications of drawdown route re liabilities , sure I have read in the past that they were treated as income plus there is a social charge element ? And no have been in the system here so not used an S1

Or whether you have private health insurance and have therefore not joined the French health system

I’m at the point where I am seriously considering moving my two company pensions (defined contribution) and possibly my one company defined benefits (final salary scheme) pension into a private scheme, specifically a UK based SIPP. I’d be very interested to know if any SFN members have done this and whether there were any difficulties on the tax front? I have heard some advisors say that the French authorities don’t like "trust based " pension funds, but others are saying it is OK.

I believe the actual transfer from company scheme to SIPP is not a taxable event in France, can anyone confirm or advise of any problems?

Then the drawdown payments (from UK to France, therefore) … I am not sure how these are taxed - could be a flat tax (35%) or maybe just as income (therefore at marginal tax rate plus CSG presumably)? Anyone had actual experience of this?

I don’t want to go ahead with something that is costly tax wise if I can avoid it at this stage!

Any replies much appreciated…

There’s some posts on this in the main 2020 Tax thread @graham set up. It helped a lot keep the various queries together this year and I hope Graham sets one up for the same next year.

I am not an expert but things seem as follows;

-

If your final salary/DB is inflation protected generally the advice would be don’t move it. If it’s CETV is over £30k then you also have to take advice from an IFA. Tends to be expensive. You can’t do a deal any more to pay only if you get a Yes move it from the adviser- that was outlawed last October.

-

It seems pensions held in the UK don’t have to be declared in France. Only payments / drawdown from them and they are declared as income here.

UK Civil service pensions ‘government pensions’ are the exception - these are taxed only by the UK. State and private pension drawings are taxed in France if you reside here.

-

The French don’t want to know about your investments unless their value exceeds 1.3million Euros.

-

Dividends are taxed at capitalist pig rates. During the calendar year in which they are earned, if your income overall is less than something in region of 22-25k, if you declare before an oct/nov date you can opt to have dividends taxed as income ie less. Noting you do your return following year and that declaration has to be done by reqd date in earnings year.

Thanks @KarenLot That’s my plan… I’m working on my own set of help sheets for next year based on this year’s experiences by contributors to the topic so, keep your eyes peeled! I may change the format slightly from the one presented by Isabelle Want and link to it in Dropbox so that any future changes are immediately available rather than, as happened this year and last, constantly reposting the same set of pdf’s but with minor admendments which could just add to the confusion.

(from your post at #29) might give the wrong impression, if not qualified. UK Government Service pensions, whilst taxed in the UK (under the terms of the DTT) still have to be declared in France as income and any tax paid is indicated in the appropriate place so as not to impose a double tax burden.

If you have an S1 then generally you don’t pay social charges. So that’s around 7.5% not taken off your income.

If you are a frontier worker or a posted worker ( basically you commute very regularly for work to Fr living in UK or to UK living in Fr and if you took up residence by 31 December 2020 in France if your work is in the UK then that’s the pre-State retirement age justification to get an S1 from your work country to present to your live country.

Other than that you have to reach UK state retirement age now for the UK to give you an S1 to hand in to the CPAM in France along with your s1106 and other supporting documentation (which they may lose, so keep copies).

Once you have the S1 it stops the social charges part of tax so 7.5%. No harm in attaching it to your Fr tax return as well.

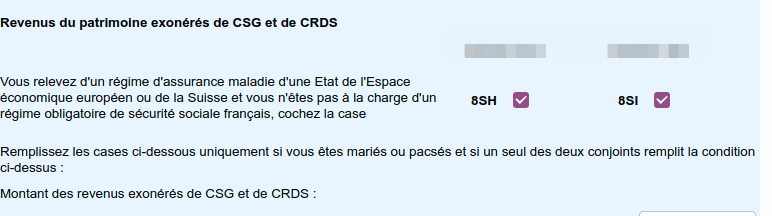

will only work if you are submitting a paper return of course (no facility with the online return process to attach documents) but you can notify the fisc of an S1 by checking boxes 8SH and 8SI for Declarant #1 and #2 (as both may not be in receipt of the S1) and if they need confirmation, they will ask you to provide it (and the means to do so).

No. The €1.3million threshold is for investments held in the form of PROPERTY value, above which you have to pay an annual wealth tax.

If you have investments in stocks, share, gold reserves etc etc normally these are also listed (and normally declared as you should hopefully be earning some moneys from them!).