Quick question. Do we have to declare all non French bank accounts every year or just new ones opened or closed ?

I had a feeling that if it was done once there was no need to enter them all again as the system remembered past entries.

That certainly was the principle but unfortunately the ones from the previous year haven’t been carried forward to this one (assuming you are declaring on-line?). However they have stated that any we now declared will be automatically carried forward next year

Thanks Angela.

This is an odd year, and we have to type them in again. But they should carry forward to next year…

This was mainly because, this year, the cerfa 3916 and cerfa 3916-bis forms were combined requiring additional information to be provided.

but yes… the requirement is for every year but if you complete the return online, the information is carried forward to the next but you still have to accept it as part of the process. Much better than the paper version though, where you would have to re-complete the information each year.

I hadn’t a clue when our 2 accounts were opened so put in a random date in 1984. Later I got a reply from the bank saying that the dates were much later, the last one being in 2008 so I went back and tried to correct but it won’t let me finish before filling in a completely new page that I haven’t seen before. So I gave up. Does anyone know why they want these dates and how can they find out about the error, and what will they do if they do?

can you describe the page? I have made amendments to my 3916’s

I daren’t Graham, I’ve already been back 3 times and chickened out by the throw back to a page with all the stuff lined in red. I can’t imagine further info is necessary as it allowed me to go right through to the end the first time and sign as normal. I got a confirmation email too.

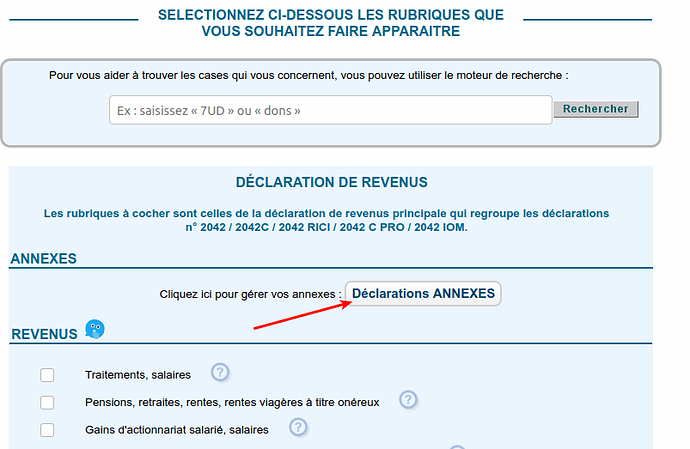

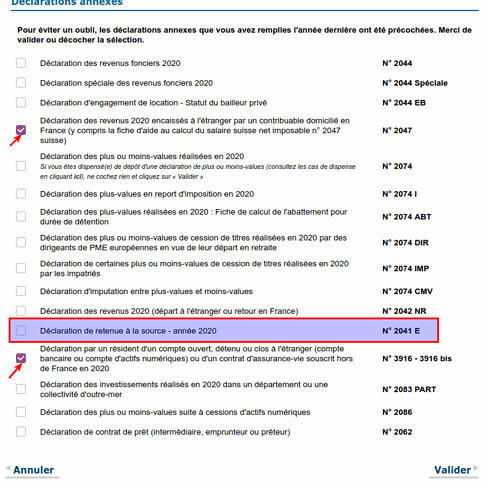

can you see Annexe 2041-E in the left panel?

can you provide a screenshot?

When I said I daren’t Graham, I meant daren’t go back after all the failed attempts. Didn’t want to look suspicious. All I remember was that it was 20 something E, so it might have been that.

The grid which appeared was all outlined in red, rather than blue.

What worried me was that it was requiring me to add figures to a page I hadn’t previously seen after first accepting my declaration without that page.

Yes that’s the bug issue I mentioned in the tax 2021 topic. It’s quite .straightforward to resolve. The form 2041-E appears in the left panel. See this post.

I know this works because I did it about 5 times to make corrections to our return.

Thank you Graham, I’ve had a look at that and will dig out my paperwork for the corrections I need to make and do as you suggest.

If I had realised what a pain this online reporting would prove to be with all the stress involved every year, and if I had realised that it was possible to opt out, I would have done so.

A very tech savvy friend on another forum simply told them he couldn’t have access to, or use, a computer and he continues to use the paper versions each year.

Every year I used to keep full copies of every page so that all was clear for me the following year. The reduced time allowed was of no consequence to me as I always did the return as soon as it arrived.

My solution to this is that I do fill in an english questionnaire provided to me from a very tech savvy French on the ball and up to date accountant who then completes my French tax return on my behalf. I then receive a printed copy of the completed return before i give the nod for it to be submitted.

I can then compare it to the previous years submission that i have on file in paper form and see how it differs.

If the bottom line for payment of tax etc feels right then i give my accountant the green light to submit and later pay thier very modest fee.

I have followed the tax thread on SF and each to thier own.

I can see the stress it has caused many and for a few euros i have avoided this and done things i enjoy instead.

Personally, I would now find it very difficult to do the paper return (due poor eyesight and motor issues getting the pen tip in the right place on the page). We did use someone to do the return when Vanessa was an AE but he has since retired and it’s not really rocket science for those with a simple pension income stream as in our case now.

My large computer monitor (on which I can simply increase text size if necessary) works perfectly well and as a retiree, I have plenty of time on my hands which I think I have put to good use with my computer skills from my dark and deep past.

Can we ask how modest? We have an accountant for the business profit and loss account, but fees are not modest! 150€/hour on average. So we don’t wish to increase the number of hours we pay for.

@graham Yes it is 2041-E Declaration Retenue a la Source, or something like that. But I can’t get rid of it. As soon as it appears in the left hand pane right clicking on it gives no option to uncheck and left clicking merely brings it up on the screen. It is only the total boxes that are bordered in red though, not the whole thing.

I can’t ignore it and go through to sign etc., as I have already done once with no problem at all, so I can’t make what, to me, are the minor corrections to the opening dates of our bank accounts, neither of which were opened or closed in 2020.

So I’ll give up and let them do their worst. We have never had an income in 21 years in France, salary or pension, sufficient to attract income tax so paying anything at all to someone else to sort what, has been relatively trouble free till this year, is not an option.

Fixed fee of 370 euros.

Considering we paid many £1000’s in the uk before moving here permanently 13 years ago we consider it very modest.

Our income stream is not simply pension based otherwise I might have considered doing the return myself but with what seems to be many twists, turns and intricacies of placing figures in the correct place and the possible expensive consequences if you dont then for me ‘its horses for courses’.

I wouldn’t expect an accountant to build a house for me nor would I expect him/her to ask me to complete their tax forms.

Rightly or wrongly l have always believed that a tax return submitted by a professional is better recieved by the authorities than those submitted by an individual.

I should also qualify that the fixed fee includes any work required after submission and up to the return being agreed and ready for payment around September/October time.

You can’t do other than follow the instructions I gave. Clicking on the 2041-E in the left pane will not get rid of it. You have to go to the beginning and follow through to the Annexes page where you untick the 2041-E line after which you can progress through the return to the 3916 to make the changes you want then to the end - always making sure tht 2041-E is not in the left pane.

As in the graphic, make sure 2041-E in unchecked (the arrows refer to the ones generally that should be checked).

Oh right, I misunderstood what you meant about the annexes page, thought it was when the list first appeared in the left pane.

I’ll go back and have another go, Thanks.

Finally got it done, phew, and the automatic receipt has arrived. Funny thing though, the corrections I had already made to the bank account opening dates, but was not allowed to confirm and sign, were already in place.

All this duly noted in my paper file ready for next year, when no doubt they will have invented something else to upset me.