I’m not in the know but ChatGPT says this

In France, an assurance vie is a life insurance contract that serves as one of the country’s most popular investment and savings vehicles. Although technically a life insurance product, an assurance vie is used more as a tax-efficient investment account than traditional life insurance. It allows individuals to invest in a variety of financial assets and accumulate capital over time while offering several tax advantages, both during the investment period and at the time of withdrawal or inheritance.

Here’s a breakdown of its main features and benefits:

- Flexible Investment Options

Assurance vie policies offer access to different types of investment funds, such as fonds en euros (euro funds) which offer capital guarantees and stable returns, and unit-linked funds (called unités de compte), which can include stocks, bonds, and mutual funds. The policyholder can allocate funds between these options based on their risk tolerance.

- Tax Advantages

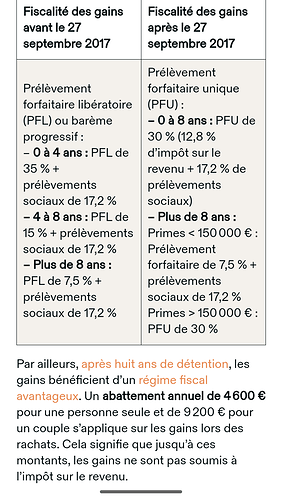

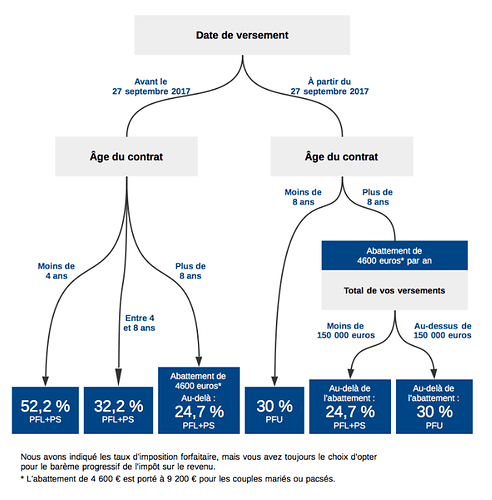

Income Tax Benefits: Withdrawals are taxed at favorable rates after a holding period of eight years. Income earned within the assurance vie can grow tax-free until withdrawals are made.

Wealth Tax Exemption: Assets held in an assurance vie are exempt from France’s Impôt sur la Fortune Immobilière (IFI), or real estate wealth tax.

Inheritance Benefits: Assurance vie policies are commonly used as estate planning tools because they allow policyholders to pass on assets outside of the typical inheritance tax framework. Beneficiaries receive these funds at a lower tax rate or even tax-free, depending on the policy and the amount.

- Estate Planning

Assurance vie policies enable individuals to designate beneficiaries directly, making it a popular tool for passing wealth to loved ones. Different tax-free thresholds apply depending on the age at which premiums were paid into the account and the relationship of the beneficiary to the policyholder.

- Liquidity and Flexibility

Policyholders can make partial or full withdrawals from the account after a specified initial period. While there are tax benefits after holding the policy for eight years, it is still possible to access funds earlier if necessary, though it may incur higher taxes or penalties.

- How It Works

The account is opened with an insurance company or a bank that offers life insurance products. The policyholder makes an initial deposit and can choose to add funds over time. The returns depend on the type of investments selected and market performance.

Assurance vie contracts can be held for life and offer flexible management options, allowing the policyholder to adjust their investments over time according to their financial goals.

Example of Practical Use

Many people in France use assurance vie to build wealth for retirement or for future projects, as the account allows for tax-deferred growth. Additionally, it’s widely used for transferring assets to children or other beneficiaries with reduced taxes.

Key Considerations

While assurance vie offers numerous advantages, it’s important to understand the potential risks, particularly with unit-linked investments, which can be subject to market fluctuations.